OUR DIFFERENCE

We are a low-cost, low-risk company that seeks consistent returns. We levy no investment management fees and management receives only a share of realised profits.

We are a low-cost, low-risk company that seeks consistent returns. We levy no investment management fees and management receives only a share of realised profits.

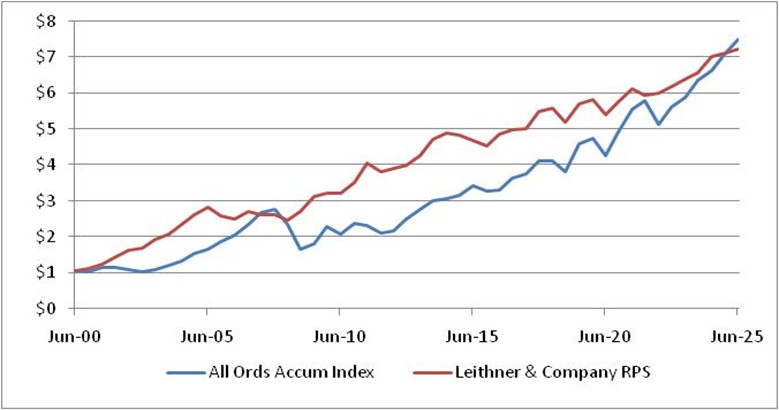

Through three crises – namely the Dot Com Bust (early-2000s), the Global Financial Crisis (2007-2009) and Global Pandemic (2020-2022) – Leithner & Co has provided consistent, long-term returns to its shareholders.

Each $1 invested on 30 June 1999, if the dividends were reinvested, would by 30 June 2025 have grown to $7.21, which equates to a compound rate of growth of 8.2% per annum.

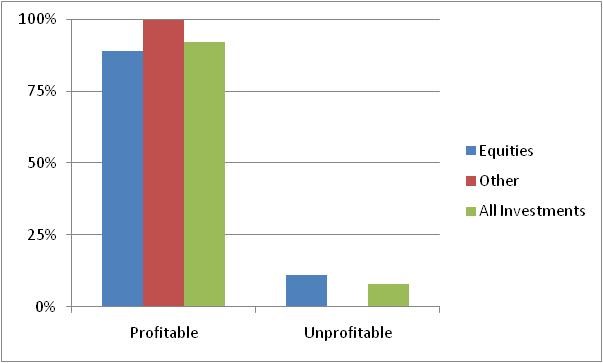

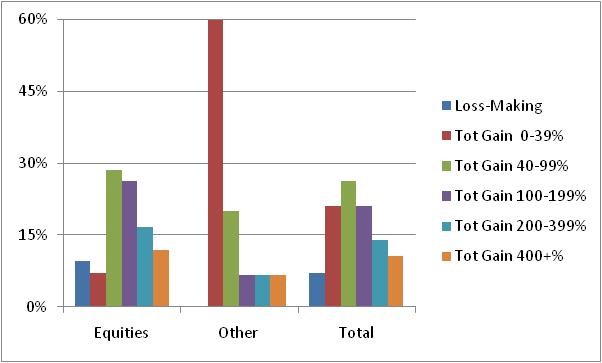

Our consistency is driven by our painstaking research. This has resulted in 93% of realised investments made between 30 June 1999 and 15 November 2025 generating profits for our shareholders.

As everyone knows, past performance is no guarantee of future returns. However, our shareholders take comfort in the fact that we will continue to implement an investment philosophy that has served us well through good times and bad.

Leithner & Co is an unlisted public company established in 1999 and based in Brisbane. It specialises in the purchase and long-term ownership of securities.

Unlike a managed fund, our results have everything to do with the dividends, payments of interest, etc., generated by the businesses of which we are part-owners – and nothing to do with the day-to-day movements of their prices.

Leithner & Co adheres strictly to a long-term, ‘value’ approach to investing. We are value investors in the manner practiced by Benjamin Graham and Warren Buffett.

Unlike virtually all other Australian investment vehicles, we levy no investment management fees. Directors’ rewards derive solely from the dividends they receive from the shares they own; accordingly, they derive no benefit from the Company’s investments unless and until shareholders do so too.

We invest conservatively, in a disciplined manner and for the long term. We do not borrow. We often forego what others regard as exciting short-term opportunities to reduce the risk to shareholders’ capital and deliver long-term results.

Directors write each year’s Annual Report and Half-Year Report as if their position and that of the other shareholders had been reversed. We want you to know everything that we’d want to know if we were in your shoes, including thorough details of current and future operations and the results they might produce.

Value investing requires independent thinking and analysis of financial statements (which are difficult and painstaking but cost little money). We’re not about flashy offices or shiny brochures, we’re driven by long-term results.

Many large-scale institutional investors react to the behaviour of their peers, hence the periodic wild swings of share prices. We march to a different drummer, one that takes a long view on investing.

Leithner & Co is an unlisted public investment company, primarily sought-out by high net worth and sophisticated investors. For over 20 consistent years, we’ve helped our investors to grow their wealth.

We believe in creating wealth through value investing. We strive to deliver long-term consistent growth, underpinned by trust and transparency.

Subscribe to keep updated on our activities.

Brand and Website by Brother & Co